Rental Housing

Definition

Legal issues Rental housing can be simply defined as a property owned by an individual other than the resident or by a legal entity, and for which the resident pays a monthly rent to the owner. In “rent-to-own” schemes, whose ultimate goal is to favor homeownership, the status as a tenant is limited to the period needed for the household to build down-payment and a record of payment. Otherwise, in “pure” rental housing schemes, there is no obligation for the owner to sell or for the resident to buy the occupied unit.It is simply a formal or informal contract between the tenant and the landlord to rent the dwelling for a certain period of time at a predetermined price.

Ownership and management There are several types of entities that can be involved in the ownership and management of residential rental real estate. The first is comprised of individuals who own a small number of units; some call them “amateur” landlords. This is the main segment of rental housing in emerging markets where these small entrepreneurs often operate in the informal sector. It is also the prevailing model in most European countries: in France, units owned by individuals are 95% of the private rental sector and 54% of the whole rental sector; in Germany, the share of individuals is 67%. The second are large scale institutional investors and owners.Most residential rental real estate in the United States is controlled by large corporate entities.

The third type of ownership structure is “social” rental housing. Here, the rules are not determined by the market (supply and demand), but rather by criteria such as maximum income, specific target groups and specific modes of allocation, and, usually, maximum rents.The commitments that define social housing may hold for a short or long, or even indefinite period, and can be imposed by law or result from a contract. Social rental housing generally serves targeted populations such as poor people, the elderly and the disabled. It has often been publicly owned and managed. This type of structure has been common in both Western Europe and the United States, not to mention socialist economies. In the few countries which remain deeply involved in social rental housing (mainly in Central and Northern Europe) the private sector now plays a dominant role through non or limited profit ad-hoc organizations (France, Netherlands, UK) or cooperatives (Denmark, Finland, Germany, Italy) along with public entities linked to local authorities (France, UK). Public rental housing has decreased in importance in many developing countries in Africa, Asia and Latin America because of operational costs and difficulties to adjust rent levels to pay for maintenance.

Background & Evolution

With the First World War, which absorbed massive capital

resources, housing investment came to a halt. Under the high levels of

inflation rates in the aftermath of the war, rents increased massively.

Governments sought to combat both shortages and rent increases by a combination

of rent controls imposed on the still abundant private rental stock, and by

promoting a new form of housing social rental housing. Governments also encouraged

home-ownership. In some cases, rental housing was even discriminated against:

an example is the exclusion of both multi-family and rental housing from

eligibility for the US public mortgage guarantee system set up in 1934 by the

Federal Housing Administration.

Most of the Middle-East countries and some in Africa

and Asia also introduced rent controls in the middle of the 20th

century, often in their hardest form: until recently in Morocco, no rent

increase was allowed if significant improvements had not been carried out; in

Egypt rents were brought down in 1952 to 65% of their 1944 level and, 15 years

after their decontrol, 40% of the rental stock in Cairo is still under this

law.

These policies

heavily contributed to urban decay and the demise of the rental sector in

Western countries and pushed the sector into informality in emerging economies.

In the UK, France, Germany, Austria, Benelux and Scandinavia, public rental

housing flourished in the aftermath of the Second World War as large subsidy

and funding programs were set up in response to housing shortages and strongly

growing populations. Some countries, most notably Germany, also subsidized

private rental housing, mostly via tax mechanisms, and saw generally high

rental housing tenure.

Towards the end of the 20th century, a

number of countries have tried to catch up on private rental sector

development. In the mid-80s, France introduced generous tax incentives for

individuals investing in newly-built rental housing. Britain after her mortgage

market crisis in the 1990s embarked on an ambitious program which saw new

rental laws, a strengthening of housing associations (at the expense of

directly publicly owned housing) and later the private buy-to-let market. Spain

has failed so far with comparable initiatives, however.

In emerging and transition economies rental is

seldom on the agenda. When it is, the main concern is the legacy of the past

(rent control). In a few cases however, the misuse of the existing stock

(Morocco), the evidence from the crisis that a large and sometimes growing part

of the population would not have access to long-term credit (Mexico), led

governments to consider revitalizing the rental sector.

Importance of Rental Housing

- First, the rental sector is a natural outlet for households that do not have sufficient income to afford buying a home, or have not saved enough to meet down-payment requirements for ownership, or do not even have access to credit. Young adults and the poorer fractions of the population fit into these categories.

- Second, vibrant rental markets are necessary for workers’ mobility as, because of transaction costs linked to purchase and mortgage loan, ownership entails higher fixed costs, which amortize on a longer period.

- Third, a robust rental sector is needed to give households a larger choice for asset investment. In most countries, housing as an asset has the two drawbacks of being indivisible and relatively illiquid, which affects the way households can manage their portfolios. Among low-middle income households in particular, the main residence is usually too large a part of their wealth. As an investment, rental housing generates a source of income that complements other income sources. In some countries it can also be a substitute for insufficient or volatile pension systems, thus being a critical element of welfare improvement for the elderly.

Obstacles often met

There a several obstacles to the (re)development of a formal rental housing market. They range from a quasi cultural bias towards home-ownership to the absence of a formal property management system. Laws and administrative systems for eviction are often biased towards the tenants against landlords, which creates significant repayment risks. This situation caused investors in the formal rental market to fly away in countries as diverse as India and Mexico (see case study).

The rental sector often has to overcome the consequences of past behaviors and policy choices such as rent controls. Based on exaggerated and highly publicized bad cases, investors see tenants as moving too often, not paying their rents, not maintaining the property, hard to evict, etc. On the other side, greedy landlords such as Charles Boycott are famous. Governments have a large share of responsibility in the bad image of the sector for their poor management of public housing, their reluctance to enforce courts’ decision concerning eviction of defaulting tenants and, above all, in imposing rent controls that resulted in lack of maintenance of the existing stock and absence of new investment. These dire consequences justify the statement that “in many cases rent control appears to be the most efficient technique presently known to destroy a city—except for bombing” ([1]).

[1]Assar Lindbeck (1972), “The Political Economy of the New Left” (New York: Harper and Row).

Finance

In

many countries, lenders will be reluctant to finance rental investments by individual

investors. In spite of the expected rent payment, they know that this type of

lending is risky as, in case of difficulty, the investor will more easily

relinquish a property he does not occupy than his own residence.

In the recent years,

low interest rates and price increases helped lending for rental to develop.

Rental investments have been a significant minority of sub-prime lending in the

United States in cities like Miami. In France, lenders easily finance individuals

investing in new rental housing because investors benefit from important tax

subsidies (above) provided that the property is rented and a rent is really

paid during six years minimum. It may be more difficult to finance a rental

investment in an old building if its location or quality is questionable.

Lending for multifamily

rental projects is very different from retail lending for ownership or rental.

No standardized debt instruments or financing process exists and multiple

funding sources are common. As a business line, it is closer to project

finance, as it relies heavily on the examination of the cash flows generated by

each particular project. As such, it is less subject to automated procedures of

loan approvals and other refinements that have facilitated the development of

mortgage lending.

Lending to social housing

In particular loans to finance

social rental housing have specific features which may pose problems to market

players. They are (very) long term, often more than 30 years, which makes it

difficult to raise matching funds. They also may have high

loan-to-value-ratios. Both factors increase the risk premium. On the other

hand, a part of the rent is usually paid by the State through housing

allowances which, on the contrary, reduces the risk to the lender. Moreover the

risk is spread over a number of properties, unlike an individual investor.

Hence the risk of such loans is often overestimated; more precisely, whereas

the LGD (loss given default) is high, the PD (probability of default) is low.

Only during the 1980s the development and liberalization of capital

markets made market funding possible for social rental housing. In the euro

zone countries, macroeconomic stability and resulting lower interest rates

allows the market to compete with the old public financing channels, at least

for organizations and programs providing sufficient guarantees. Public funding

has not completely disappeared but has often changed shape. France is the only

country in the euro zone in which the main funding source is, if not exactly

public, at least centralized at the national level. In Poland, recently created

TBS organizations also relied on public funding but public sector reform and

budget constraints now leaves them in an uncomfortable position (see case study).

In some cases, access to

private finance has been made possible by strong public guarantees (UK,

Netherlands and Finland). In addition to usual types of guarantees, providers

in different countries have been implementing for a few years innovative ways

of pooling risks, for example, the issuing of bonds via special purpose

vehicles (Austria, Switzerland).

Main Approaches to Improve or Expand Rental Housing

Improving the legal framework

In Morocco, the share of rental housing in the urban stock was rapidly

decreasing and the vacancy rate was high. New investment was scarce and only by

individuals renting one floor of a house. The main reasons were: many defaults,

lengthy procedures, eviction difficult; no rent increase possible if no

improvement works; tax discrimination against rental. A new legislation has

been drafted. Its main features are:

- A written lease is required, clearly stating the rights and obligations of the landlord and of the tenant, including the cases when the owner may recuperate the unit and those when the lease may be cancelled, the amount of the security deposit (two months’ rent);

- Rent will increase every three years (8%);

- A written description of the premises is required when the lease is signed and when it expires;

- The unit must be habitable and decent;

- Minor repairs are the responsibility of the tenant; written agreement of the landlord needed before making improvements.

Ending rent controls

Ending rent control is a difficult move: it takes time and requires political courage as it is not rewarding in the short-term.Liberalization of new rental contracts is rather simple; de-grandfathering old contracts is not.

In Egypt, a 1996 law that freed the market for newly-built and vacant units started reviving the rental market: 80% of new units accessed in 2001-2006 were through rental. But 42% of the housing stock in greater Cairo is still frozen under rent control:3.7 million housing units (32% of the urban stock) are unused, either vacant or closed (see case study).

In the Czech Republic, rents of new leases (new and vacant units) in former public flats were freed in 1994 but this deregulation was declared unconstitutional in 2003 and became subject to tenant’s agreement; otherwise, the rent was frozen until 2006.In 2006, the act on One-sided Rent Increase still gave priority to free agreement; otherwise, the landlord was entitled to increase the rent according to the formula included in the Act with the aim of reaching the level of 5% of average regional market price.

International experience provides lessons for rent decontrol reform

First, a gradual approach is recommended. Rent adjustments need to be phased in order to create gradual convergence toward market rents and limit the financial burden of tenants. However, initial shock adjustments are justified when controlled rent levels are extremely low compared to operating costs, in order to limit the losses from depreciation, which is the case in Egypt. Moreover, some sort of support for needy tenants should be designed. In Spain, the administrative complexities lead here to some reform delay.

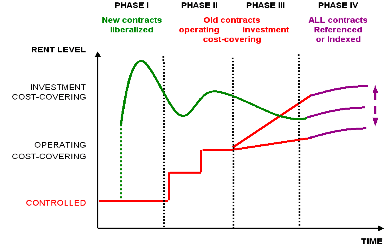

Second, the agreement of tenants to a decontrol process cannot be obtained without a proportional service being provided by the landlord. This is clear in the case of rents that are not sufficient to cover current operating costs (Phase II in figure 1). However, beyond that level rent adjustments should be permitted in exchange for capital repairs and modernizations (Phase III in figure 1).

Third, final rent control regimes need to be defined for all rental contracts, eliminating inequitable situations between tenants. Finally, while there is no systematic empirical analysis on the impact of liberalization on rent levels, there is ample anecdotal evidence of initial overshooting phases being followed by calmer periods, resulting in a decrease of initial tenant resistance (green line in Figure 12). The rule of thumb is that the larger the rent controlled stock relative to the total stock is, the more pronounced the initial overshooting and the more likely a subsequent relative decline in rents will be.

It is important that all rental contracts be treated alike. As the Spanish example shows, second generation rent legislation after an initial liberalization is often necessary in order to react to market failure, to significant increases in rent and contract term volatility, or to abuses. More importantly perhaps, in combination with de-grandfathering the regulatory system must unify the legal framework for all rental contracts and buy important political support for a de-grandfathering strategy by reducing popular anger against reforms.

Figure 1: Rent decontrol process - a stylized portrayal

Improving the rate of return

Next, an even playing field with other investments, non residential real estate and financial products, should be createdin order to bring the return and risk of the housing investment in line with these other vehicles. The necessary adjustments should be made through taxation and insurance products. These prerequisites should enable investors to have a better access to market finance.

Multiple ways can be used to increase the net (after tax and operating expenses) rate of return:

- For rental at market prices, tax solutions (ending discrimination against rental, allowing accelerated depreciation, etc.) should be considered first;

- Subsidies such as grants, VAT rebates or subsidized loans should be accompanied by matching commitments (such as income limitations and/or maximum rent levels);

- For low-income tenants, housing allowances are now preferred, because they are better targeted and more flexible but they are a fiscal and administrative burden which most emerging countries will find too heavy. Reducing the risk is of primary importance to lenders.

Two main families of instruments can be used:

- Insurance products devised to insure the cash flows produced by the property to the landlord,

- Credit enhancement products applying to individual mortgages (aimed at primary lenders).

Among the first category, one finds insurance for rental payment for landlords (late or non-payment, degradations, sometimes legal costs). In the second category, mortgage insurance is the most popular product. Mortgage insurance insures lenders against loss in the event of mortgage defaults. In so doing, it makes capital more readily available to the borrowing investors. There also exists credit enhancement products applying to the bonds issued to finance the investment (aiming at achieving a triple-A rating for the bonds).

Key cases to watch

The Cases of India and Mexico: Six Reasons Why Formal Rental Markets do Not Work

- The cultural bias in favor of home-ownership - India and Mexico share this attitude with all emerging economies and a large majority of developed countries. The bias seems to be particularly strong in India because Indians privilege savings and prefer tangible assets such as real estate and gold. Moreover, unlike gold, the prices on the housing market are characterized by a constantly ascending trend and India has so far avoided the booms and busts usually affecting this market; the appreciation of the property is thus deemed as guaranteed.

- The legal framework - In India, landlords have long been deterred from investing by the legal framework which was, and often is still, extremely imbalanced in favor of tenants: eviction was impossible, case resolution might take several years and rents were blocked at a very low level by the Rent Control Act of 1947, with only recent decontrol, which is incomplete in some states. In Mexico, the problem is of a lesser magnitude. After rental laws favorable to tenants were passed in the 1970s, there has been a trend towards a more favorable treatment of owners (Civil Code reform in 1994).However, according to potential investors, the legal protection afforded to residents remains a great barrier to stimulating a large scale residential real estate industry.

- The rate of return - Due to the scarcity of formal investors and of data, the gross rate of return is estimated to be close to 10% on both markets and lower in the best locations; the net yield (after expenses and taxes) is therefore far below this level and may be less than 5%, depending on the tax bracket of the landlord. The consequences are different in India and Mexico investors in India will prefer to keep their property vacant and thus be able to cash the capital gain any time; this attitude entails a high vacancy rate in the housing stock. In Mexico the vast majority of individual landlords will rent informally to avoid taxation.

- Lack of incentive for investors - There are no subsidies provided for rental housing by the federal or state governments, except for the Army; in India the public housing stock was sold to tenants in 1978; in Mexico, in a similar way,there has been no federal program of social rental housing for 25 years and there is no housing allowance or voucher program.

- Lack of adequate finance - The overall financial system would not readily provide equity capital or long term debt for investment in multi-family residential rental developments. Even if it did, there would be no leverage effect possible as the net rate of return is much lower than interest rates of long-term mortgages.

- Lack of formal property management - Unlike non residential properties, there is no formal property management system for the housing rental stock. Professional management is essential in multi-family rental housing as the net operating income highly depends on rent collection, and on adequate level and timing of maintenance. This “operating leverage” is the necessary complement of the “finance leverage” mentioned above. All these issues need to be addressed in order to pave the way to a substantial investment in formal housing.

Poland: A new Social Housing Sector to Fill the Market Gap

The rental residential market is made of the following segments:

- Municipal housing, mostly untargeted (except for “waitlist allocations”), with highly preferential rents (of about 1.5% of the replacement value[1]), which encourages tenants to stay rather than leave. It includes “social-intervention” units targeted at vulnerable households (mostly low income) with very low rents as municipalities have, by law, the obligation of housing the homeless;

- The old (pre-1945) private stock, restituted to the previous owners (when found), rented formally and governed by tenant-protection law and regular taxation regime, with rents very close to the 3% replacement value limit set by the law (see below);

- The recent private stock: consisting individually rented dwellings, most often informally, targeted mostly at students, migrant workers as well as foreigners and companies (for employees). Rents are highly variable, but are often 5 to 10 times higher than in the municipal stock;

- The system of social rental housing (TBS): inspired by the French HLM system, it was introduced in 1995. The main operators are non-profit social housing companies owned by municipalities, but some are fully private and some others mix public and private capital. Rents should not exceed 4% of the replacement value. They are heavily subsidized (through provision of equipped land and low-interest loans by the State bank BGK[2]). However, their tenants are not the poorest but mostly middle-income workers who have to contribute up to 30% of the construction cost without being granted a right to buy in return. Moreover, the number of units produced is far beyond expectations; - Cooperative housing: some cooperatives offer so called “coop rental rights”, which require some “key-money” from tenants and thus resembles the TBS concept;

[1] An administrative parameter representative of construction cost established by local authorities. [2] The State cut its subsidies and a revision of the system is under way.

Egypt's Rental Stock After 10 Years of Decontrol

Much of Egypt’s housing stock still remains constrained by very high vacancies, as a consequence of rent control and lack of alternative inflation-proof investment. Almost 3.7 million housing units are unused, either vacant or closed. According to the 2006 census, the total number of unused units in urban areas in Egypt reached 4.58 million units, of which 1.18 million were closed and 3.40 million were vacant.It was estimated that more than 80% of these 4.58 million unused units are for housing use.The scale of vacant urban housing units is a specific and puzzling phenomenon of the Egyptian housing market.One explanation is that the sustained rapid appreciation in value over the past 25 years or so and the lack of alternative investment mechanisms until quite recently meant that housing and real estate have consistently served as an inflation-proof savings and investment mechanism, without need of the rental yield. The idea of renting was even less attractive due to the imposition of rent control until 1996.Even now, the continued perception of uncertainty about the enforceability of the new rental law makes many owners hesitant to put their unoccupied units to rent.Poor targeting of government subsidized units, as well as the mostly unattractive locations in New Towns, have also further exacerbated the problem.

The series of rent control laws imposed by the government as early as 1944, but especially during the 1950s and 1970s, has had serious effects on the housing market.Rent control was originally conceived as a temporary measure in the aftermath of World War II; it was later extended to preserve housing affordability for limited income groups. Rent control forced housing investors to concentrate solely on building housing for sale, which implied a focus on the upper income segment of the market. Professional long-term investors in rental housing, such as insurance companies, exited the market facing severe losses on their existing holdings. At first, rent control law applied only to units built during the 1940s, but controls were gradually extended and applied to all new construction (i.e. no targeting).

Renting is tantamount to owning, for the insiders. Rent control prompted the application of key money for new rental contracts or to release an old rent-controlled agreement.A comprehensive World Bank study on the rental sector in Cairo found that, in practice, key money is roughly equivalent to the net present value of the difference between market rent and the frozen rent level over the duration of a long-term tenancy contract.[1] In effect, renting has been tantamount to owning in Egypt, and households expect to have – and have had – exceptionally long leases relative to most other rental markets worldwide.

Bequeathing rules create new generations of insiders and perpetuate distortions. The 1996 law grandfathered existing rental contracts, thereby allowing units to be passed on one time to a family member (parent, spouse, offspring, or any relative of the first degree) living in the household 2 years prior to the death of the tenant.Indeed, this provision, although not uncommon for rent decontrol in its first phase, is frequently abused. A typical form of abuse seems to be children, or even grand-children, moving into the apartment shortly before the anticipated deaths of parents or grand-parents, just to comply with the letter of the law. Anecdotal evidence about more serious infringements includes the changing of residence on the government issued identification card and the name on household utility bills to prove occupancy. As a result, about 50% of tenants in the age group 25-35 years (household heads) are living in controlled stock, paying rents usually not exceeding 5% of stated household income.

An estimated 42% of the housing stock remains frozen under rent control. Since the passage of Law No. 4 of 1996 that freed the rental market for newly built and the then-vacant units, but grandfathered existing rent-controlled units for the duration of the contract, the rental market is showing signs of much dynamism.The TAPRII Greater Cairo Housing Demand Survey found that 81% of all the new units accessed in the 2001-2006 period were through rental contracts signed under the new law (only 19% were for ownership).Yet, the TAPRII survey also indicates that 42% of the total urban housing units in Greater Cairo are still locked under the rent control regime as a result of grandfathering, and that this is not necessarily benefiting the poor.This greatly constrains residential mobility, locks a large proportion of units out of the market, causes lack of stock maintenance, and distorts the overall housing market.

Going forward, without further action, the rent-controlled sector will remain for another three decades. The current situation of massive bequeath of old rental contracts to the younger generation will likely leave Egypt with a large part of its housing stock under rent control for a long period. A simulation suggests that it could be three decades[2]. Even a radical reform scenario in which bequeath would be prohibited altogether would still mean that Cairo had a rent-controlled sector of 14% of the housing stock by 2016.

[1] Hardman, A, Malpezzi, S. and S.Mayo. 1995. “Egypt Rent Regulation Reform Study for the Arab Republic of Egypt”. Study commissioned by the World Bank. Cairo.

[2] Based on the TAPRII Survey, about 50% of the old rental contracts are bequeathed to the next generation, for whom both mortality rates and conversion or termination incentives will remain low over the coming decades.

Related Documents

About the Editor

ContactWebsite

Hans-Joachim (Achim) Dübel is an independent international consultant with 20 years of experience in housing finance. Based in Berlin, he is the founder of the financial and housing/real estate sector think tank FinpolConsult. Before founding FinpolConsult in 2004, he worked on staff of the Financial Sector Development Department at the World Bank in Washington and as a free-lancer.