- Australia and New Zealand

- Europe and Central Asia

- Albania

- Armenia

- Austria

- Azerbaijan

- Belarus

- Belgium

- Bosnia and Herzegovina

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Georgia

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kazakhstan

- Kyrgyz Republic

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russian Federation

- Serbia

- Slovak Republic

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

- Uzbekistan

- Latin America and the Caribbean

- Antigua and Barbuda

- Argentina

- Bahamas, The

- Barbados

- Bolivia

- Brazil

- Chile

- Colombia

- Costa Rica

- Dominica

- Dominican Republic

- Ecuador

- El Salvador

- Grenada

- Guatemala

- Guyana

- Haiti

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Paraguay

- Peru

- St. Kitts and Nevis

- St. Lucia

- Trinidad and Tobago

- Uruguay

- Venezuela

- Middle East and North Africa

- North America

- South Asia

- Sub-Saharan Africa

Home > Countries > East Asia and the PacificMongolia

Country Profile

Mongolia is a landlocked country bordering with the Russian Federation to the North and the People’s Republic of China to the South. The country occupies 1,564,116 sq km, and is ranked as the seventh largest country in Asia and the 18th largest in the world. Its population is 2.5 million, making Mongolia’s population density the world’s lowest. As of April 2007 more than one million people or 38% of its population lived in the capital city, Ulaanbaatar, which is growing rapidly. Nearly 67% of the city’s population is less than 35 years old. Mongolia’s terrain is characterized by vast semi-desert, grassy steppe, and mountains. Arable land constitutes less than 1% of the total area.

Mongolian housing finance began in 2001 when banks started issuing limited mortgage lending. The process was kicked off with on-lending activities of the ADB Housing Finance Sector Program (HFSP) in May 2003. Five large commercial banks participated in the program. As of 21 December 2007, over 2,400 loans totaling MNT 28.2 billion have been disbursed under this project.

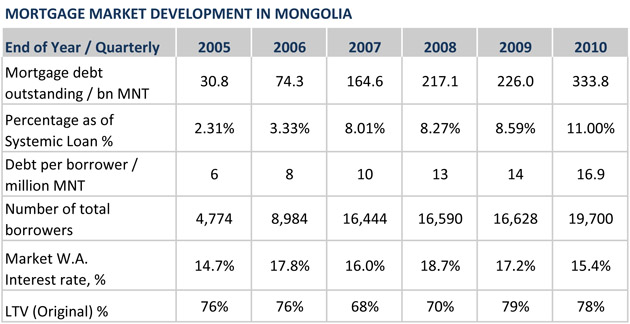

Mongolia has a total of 15 commercial banks of which 9 banks issue mortgage loans. Since 2003, outstanding mortgage loans increased by a factor of close to 40.

In recent years the housing supply expanded significantly, related to the fact that a growing proportion of the creditworthy population could receive mortgage loans. Roughly 38% of the population lives in apartments and the remaining 62 % percent resides in ger dwellings, the rural vernacular housing type of Mongolia.

As the majority of the population lives in a ger dwelling, the Government of Mongolia launched several housing programs to promote access to affordable housing. On June 2006, the Government approved the ”40,000 Houses Program,” followed by the 100,000 “New Development Program” in June 2010, and an additional 4,000 unit housing program. The overall objective of these programs is to increase the total national housing supply and related mortgage finance for housing for middle and low income households.

In September 2006, the Bank of Mongolia – along with ten commercial banks – jointly established a private sector-controlled secondary mortgage institution called the Mongolian Mortgage Corporation (MIK). The main goal of the institution is to develop primary and secondary markets by issuing and selling Mortgage-backed securities on domestic and foreign capital markets, and to create and ensure a smooth, long-term financing system that will improve access to housing and promote modern urban development.

About the Editor

Mongolian Mortgage Federation (MIK)Contact

Mongolian Mortgage Federation (MIK)Contact

WebsiteThe Mongolian Mortgage Corporation (MIK) was established in 2003 to promote and develop primary and secondary mortgage markets to create and ensure an efficient, long-term financing system. MIK’s mission is to promote affordable home ownership and urban development for Mongolia’s people.

Copyright © 2026. HOFINET. By using or accessing this website, you signify that you agree to the Terms of Use.

When using or citing any information displayed on this website or accompanying blog sites, you must provide a reference to HOFINET.